This article shows how some of the risks Apple has been toying with regarding iPhone specs are now catching up to it.

Together with overall smartphone weakness due to a "good enough" effect, these risks allow for a significant prediction.

The prediction is that by Q2 FY2016 at the latest, Apple will probably be seeing year-on-year shrinkage for the iPhone 6s.

I've often written about how Apple (NASDAQ:AAPL) is taking some risks with the iPhone which are, in a way, new. They are new because with Steve Jobs and up to the iPhone 4/4s, Apple tried to keep ahead of the spec race, deploying the most advanced solutions available at the time, including such things as the display resolution, camera resolution and quality and even the RAM size and storage size.

That all ended with the iPhone 4s. Since then Apple has let iPhone specifications lag those of most Android flagships. While rational tradeoffs can somewhat explain such lag, the lag is nonetheless real.

I've talked about these risks in such articles as "Apple: Android Photography Is About To Take A Huge Quality Jump" and "The Android Blunders That Helped Apple". Some time has passed since then, so now might be a good time to revisit how things are evolving regarding this thesis and whether some of these risks are materializing.

In the meantime, Apple has launched the iPhone 6s, and while some of the risks were addressed, many remain. It can be argued that due to Apple's leadership in SoC design, as well as the strength of its brand and ecosystem, the Apple iPhone is and remains the smartphone to beat. Yet, something is slowly changing.

The Camera RiskAs I said, I've already written on how Android smartphones were going to get a whole lot better in the camera department in general. Up until the iPhone 6, Apple was the undisputed leader when it came to cameras. The iPhone had a resolution of "just" 8 Megapixels, but it made up for it in image quality and ease of use. Android phones, try as they might with their higher pixel counts, came up short. This iPhone advantage was well-known in the market, and a subject of many articles claiming it as a powerful reason to get an iPhone, such as this one from TheVerge, titled "To beat the iPhone, you have to beat the iPhone's camera".

By then, however, there was already an inkling of change. Competitors were drawing near, and Samsung (OTC:SSNLF) with the Note 4 in particular seemed for an instant to have matched or surpassed the iPhone with a smartphone of the same generation. Yet, if you were going to choose based on cameras, you could get the iPhone, or a single Android smartphone out of the dozens or hundreds of different Android models.

Their just being an exception would not stop the iPhone juggernaut when it came to the camera. Hence the relevance of what I described in my article - that soon many Android handsets would get much better cameras, even down to the midrange of the market. Such a thing happening would, obviously, eliminate the camera advantage when the camera came to be the deciding factor.

Well, for the most part that day arrived. The iPhone lost its top camera spot. This happened both because Android smartphones evolved rapidly as predicted, and ironically because Apple, in trying to up the pixel count while remaining stingy with its costs, managed not to improve the iPhone 6s camera at all (while moving from 8 Megapixels to 12 Megapixels).

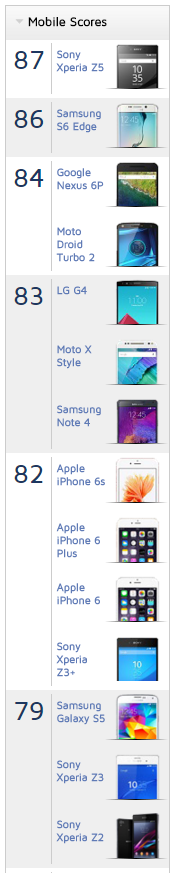

There is an abundance of reviews which will argue that the iPhone is still on top or was just matched at the top. However, the most objective and renowned photography/mobile photography website seems to have confirmed what others had already been saying subjectively.

I am talking about DxOMark. Previously any beating of Apple was sporadic and quickly erased. However, now Apple is left behind even though the next generation of several of the Android devices which surpassed it will be out before the next iPhone model.

Also, very relevantly, the iPhone was not just matched or surpassed by competing flagships. It was also surpassed by smartphones which will cater to the midrange, such as the $379 Nexus 5X (same camera as the Nexus 6P listed in the table) or the Motorola X Style / Pure Edition which while being a flagship, comes at a midrange price ($399.99). This trend, of course, is likely to soon expand even to Chinese midrange smartphones, now costing around $200-$300.

How did this ultimately happen to Apple? I think there were two factors at work beyond Android cameras simply getting better. These were:

To sum things up, the camera risk which was identified has slowly materialized. Today getting one of the best camera smartphones no longer requires buying an Apple iPhone. Indeed, it's starting to even be possible to choose a mid-level Android phone and get a competitive high-quality camera with it.

The Virtual Reality RiskOne of the other risks I've mentioned is how Apple had been shipping unnecessarily low-resolution displays with its top-end phones including the iPhone 6s. At this point, the Apple iPhone 6s has a display resolution of 750x1334 pixels. This is nearly the same as 720p (720x1280 pixels). 720p at this point in time is only found in the lowest rung of Android phones. This means budget phones costing little more than $100, unlocked.

The reasoning is that the user might not see the difference anyway, though even Apple uses a higher resolution (1080p, 1920x1080 pixels) for its larger iPhone 6s Plus. This reasoning may at times make sense in power consumption and speed, but one also needs to remember that even if the user cannot really see the difference, this is still a high-end product and as such it becomes strange when it fields such obvious low-end specs.

The problem, however, becomes even more evident when the difference can actually be seen. This might happen because of the phone having a non-standard display resolution. The iPhone's resolution is slightly different from 720p, so 720p content needs to be adapted either by not using all the display or by scaling to a non-native resolution which will destroy some of the detail and contrast. But that's just a "might". There's also a "definite" to talk about.

I am talking about VR (Virtual Reality). The virtual reality boom is slowly taking place and awareness should explode during early 2016, when Facebook launches the Oculus Rift. Mobile phones can also provide a good VR introduction since they have all the requisites, including the movement sensors, high resolution displays and powerful mobile GPUs.

Now, when using a mobile phone as a VR display, you use a headset where the mobile phone is inserted. This headset includes 2 lenses for one to be able to comfortably focus on the display at such close range. These lenses expand the display to fill your visual field, and thus immerse you in its artificial reality. When the lenses magnify the display, it becomes a lot easier to see the pixels, creating a kind of grid effect. This grid is much more visible the lower the display resolution is. By now you see where I am going. The following image exemplifies the problem:

(click to enlarge)

Click on that image to see it in full size. The left side of the image shows a VR headset running at 720p, while the right side shows a headset running at 1080p. As you can see, the effect is much worse on the 720 display, as is to be expected.

The same thing happens with VR using smartphones. So even if you couldn't see the difference with your naked eyes, now you can see it when the VR headsets hit the market en masse. One such headset is the recently-launched Samsung Gear VR, retailing for just $99:

(click to enlarge)

(Source: Samsung)

So, this particular headset isn't even compatible with the iPhone and it showcases Samsung's superiority at a very cheap price. To have it, you'll need a recent Samsung smartphone. Maybe it's also symptomatic why Apple doesn't have the equivalent product -- because it would expose the iPhone's weakness.

In this or any other more generic VR implementation (like the very basic Google Cardboard), one thing will become painfully evident during the VR boom: that iPhones are awfully inadequate.

(Source: Google.com)

So here, again, Apple is running an unnecessary risk. And one which will be most evident for the younger generation, the generation defining what "cool" is. Do you reckon it will be cool to experiment the latest revolution using an inferior device by design? I don't think so.

The "Good Enough" RiskOn top of the risks Apple is taking with its iPhone breadwinner, there's a general effect taking place which hits both Android handsets and the iPhone alike. It's just that like PCs, these smartphones are increasingly getting "good enough".

If you hold a flagship smartphone from two years ago, be it an LG G2, Nexus 5, iPhone 5s or any other phone built to similar specs, you'll notice that it can do the same things as today's flagships and the speed difference isn't deal breaking. These phones actually remain competitive with today's mid-end phones, and today's mid-end phones are entirely usable and will remain usable for years.

Except for battery degradation, which will be cheap to solve, and some general care with software, these phones should thus start eliciting longer substitution cycles. This should drive a stagnated or slow-growing market both for Android and the iPhone.

The Result: Possible Q1/Q2 year-on-year Drop In iPhone ShipmentsWhere do all these risks lead to? They lead to the chance that all smartphone flagships start having trouble showing year-on-year growth rates.

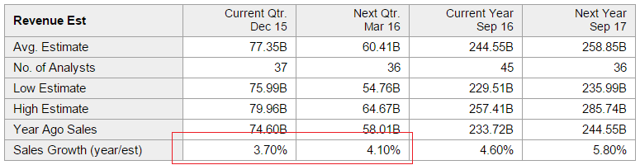

The iPhone is particularly vulnerable because it finally sated the demand for a larger-display iPhone with the iPhone 6. It might thus not be surprising that by Q1/Q2 FY2016 Apple will have difficulty in seeing year-on-year growth in revenues and profits. Present consensus already only allows for weak +3.7% and +4.1% year-on-year growth in revenues for Q1 and Q2 as we can see:

(click to enlarge)

(Source: Yahoo Finance, red highlight is mine)

But it can easily be worse. For instance, there are reports of iPhone 6s sales dropping up to 15% year-on-year in Japan, and "declining meaningfully" as per Pacific Crest. Q1 FY2016 might be the first quarter to show this, and if not then Q2 FY2016 will certainly be it.

While AAPL is already priced for some demand weakness, it should be evident it's not priced for stagnation or shrinkage of iPhone sales. The consensus estimates say as much, AAPL will not have rising year-on-year EPS if the iPhone posts negative year-on-year sales.

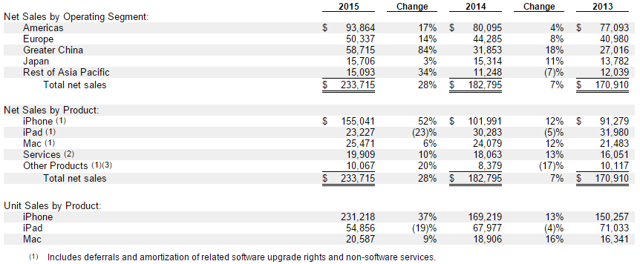

RelevanceAs always, Apple is the iPhone. Apple's stock will mirror the iPhone's performance. The iPhone represented 2/3rds of Apple's FY2015 revenues, and due to its higher gross margins it likely represented 80%+ of Apple's operating and net profits.

(click to enlarge)

(Source: AAPL FY2015 10-K)

With such a large relevance for Apple's financials, anything that happens to the iPhone will be determinant to what happens to the stock. Talk about Apple Pay, the iPad Pro, the Apple Watch and anything in between is basically irrelevant for the stock right now. When it comes to the stock, the iPhone is all that matters.

ConclusionThe risks about which I've talked in the past are materializing, rendering Apple's iPhone unique competitive position weaker and weaker. By now, the iPhone has been matched or surpassed by several Android handsets in the camera department. At the same time the iPhone risks being "uncool" when the VR boom hits in full, since its lowly display resolution will show the handset to be inferior for that purpose.

These risks are also compounded by the fact that increasingly smartphones have less and less to offer in terms of added capability justifying upgrades. Their life cycle will be extended by this effect, slowing down replacements and overall demand.

For Apple stock, this is tremendously important. The iPhone is so dominant in Apple's financials that any failure to show continued growth is sure to have an outsized impact on them.

Given the risks, both specific and general to the smartphone market, along with Apple's pent up demand which inflated FY2015 iPhone sales, it's now likely that by Q2 FY2016 at the latest, Apple will be showing year-on-year declines in iPhone shipments. This is not yet in the share price, so AAPL is likely to underperform until July-August 2016. By then, of course, the focus will change to the upcoming iPhone 7.

Source: Several iPhone Risks In Review: Apple Is About To Show Declining iPhone Shipments

T-Mobile gambles consumers will go lower def for free viewing

T-Mobile gambles consumers will go lower def for free viewing